简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

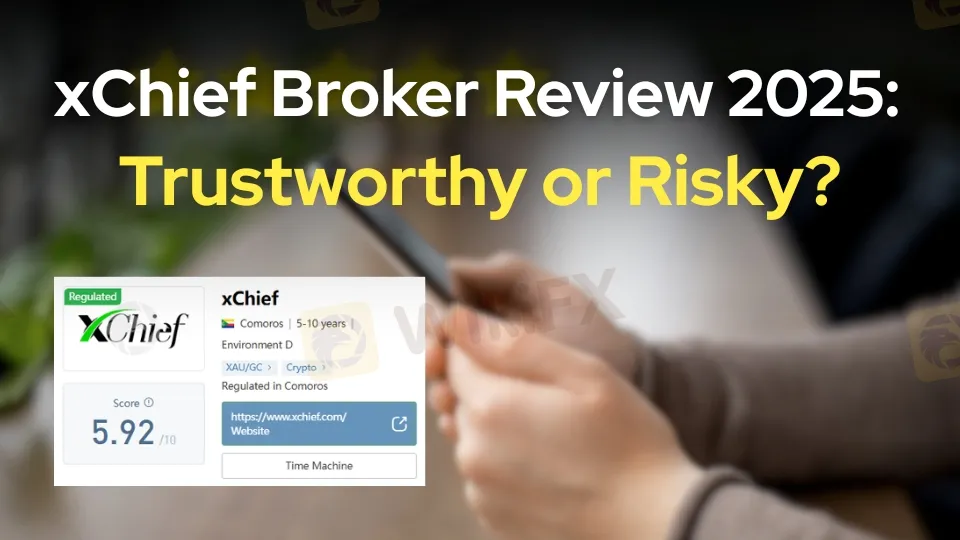

xChief Broker Review 2025: Trustworthy or Risky?

Abstract:Explore our 2025 review of xChief, a Comoros-based forex and CFD broker. Assess its regulation, trading environment, user feedback, and risks to determine if it’s a reliable choice for traders.

Overview

xChief Ltd, operating as xChief, is a forex and CFD broker registered in Comoros, active in the financial markets for 5–10 years. It offers trading in forex, metals, indices, and CFDs on stocks, with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The broker provides customer support via email and phone. Concerns about its regulatory framework, trading conditions, and user feedback raise questions about its reliability. This review, based on data as of May 30, 2025, evaluates whether xChief is a trustworthy broker or a high-risk option.

For additional information about xChief, please refer to the link below.

https://www.wikifx.com/en/dealer/8991677658.html

Ratings and Performance

xChiefs performance is rated average, scoring roughly 5.9/10 based on industry evaluations. The breakdown includes:

- Regulation: 5.9/10 – Concerns persist about the strength of its regulatory oversight.

- License: 6.0/10 – Licenses exist, but their credibility is questioned.

- Business Operations: 7.6/10 – Operations are stable but not exceptional.

- Software: 5.9/10 – Issues with platform reliability or user experience are noted.

- Risk Control: 9.1/10 – Strong measures to protect client funds.

xChief ranks poorly among competitors, placing near the bottom of similar brokers due to user complaints and operational concerns, positioning it as a lower-tier choice.

User Feedback and Reputation

User reviews are mixed, with 34 feedback entries from various sources. Some traders praise xChief, while others report significant issues:

- Positive Feedback: Users like “Arif Jamil” commend low spreads and fast withdrawals, describing xChief as “perfect” and efficient. Another “FX1772412777,” highlights its suitability for beginners and pros, citing a $100 welcome bonus and a $10 minimum trading threshold.

- Negative Feedback: Complaints focus on withdrawal delays and poor support. “FX9299818777” noted fast deposits but slow withdrawals, cautiously recommending xChief. A user titled “Looks alright on the platform” reported a 10-day withdrawal delay and unresponsive support. Another trader cited a $108 loss due to platform instability, warning, “Be careful when trading with xChief, the platform is not stable.”

While some users find xChief satisfactory, recurring issues with withdrawals, support, and platform stability undermine its reputation.

For real user feedback and experiences with xChief, visit the link below.

https://www.wikifx.com/en/dealer/8991677658.html

Regulation and Trustworthiness

xChief claims regulation from two entities:

- Mwali International Services Authority (MISA) – Comoros: xChief holds a Retail Forex License (No. T2023379), effective since October 2023. This offshore license is less stringent than those from top-tier regulators like the FCA (UK), ASIC (Australia), or CySEC (Cyprus), raising concerns about client fund safety.

- Australian Securities and Investment Commission (ASIC) – Australia: Operating under MGF Capital Pty Ltd with a representative license (No. 001312104) since October 2024, xChief is not fully ASIC-licensed but overseen by another entity. This offers limited protection compared to a direct ASIC license.

The combination of an offshore license and a limited representative license suggests weak regulatory oversight. Frequent user complaints and a low industry ranking indicate xChief is a higher-risk broker, though not currently classified as a scam.

Physical Offices

xChief lists offices at:

- United Arab Emirates (UAE): Suite 30-17, Park Lane Tower, Business Bay, Dubai.

A recent field visit to the UAE address found no evidence of xChief‘s presence, with the office occupied by another company and no signage indicating xChief’s operations. This raises transparency concerns. The Australian office aligns with its ASIC representative license, but the unverifiable UAE location and incomplete Comoros address suggest that xChief may not be as established as claimed. Traders should verify its operational status.

Trading Environment

xChiefs trading environment has significant drawbacks:

- Average Transaction Speed: 1016 ms (Poor) – Slow execution risks slippage, impacting scalpers and high-frequency traders.

- Highest Transaction Speed: 672 ms (Poor) – Below industry standards.

- Highest Speed of Opening: 703 ms (Poor) – Hinders timely market entry.

- Lowest Speed of Opening: 1609 ms (Good) – Less relevant than average performance.

- Highest Speed of Closing: 194 ms (Poor) – Affects profit-taking or loss-cutting.

With an occupied margin of $2,692,948 USD, 414 test users, and 2876 orders executed, xChief shows activity but struggles with frequent platform disconnections, poor transaction speeds, and unfavorable slippage and rollover costs, indicating an unreliable trading environment.

Pros and Cons

Pros:

- Offers MT4 and MT5 platforms, widely trusted by traders.

- High-risk control score (9.1/10), ensuring robust client fund protection.

- Positive feedback highlights low spreads and a $100 welcome bonus.

- Physical office in Australia, tied to its ASIC representative license.

Cons:

- Weak regulatory framework with an offshore Comoros license and limited ASIC license.

- Slow transaction speeds (average 1016 ms), causing slippage and poor performance.

- Frequent complaints about withdrawal delays and unresponsive support.

- Low industry rating and poor ranking among peers.

- Platform instability and frequent disconnections were reported.

- No verifiable office in the UAE, raising transparency concerns.

Visit the link below to see how xChief can support your trading goals.

https://www.wikifx.com/en/dealer/8991677658.html

Conclusion

xChief presents a mixed profile as a forex and CFD broker. It offers popular platforms (MT4/MT5), strong risk control, and some positive feedback on spreads and bonuses. However, its regulatory framework—an offshore Comoros license and a limited ASIC representative license—lacks the robustness of top-tier brokers. Slow transaction speeds, platform instability, and frequent user complaints about withdrawals and support erode trust. The absence of a verifiable UAE office adds to transparency concerns. As of May 30, 2025, xChief is not an outright scam but carries significant risks due to weak regulation, poor trading conditions, and operational doubts. Traders should exercise caution, conduct thorough due diligence, and consider brokers with stronger regulatory backing, better trading environments, and verified operations for a more secure trading experience.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Planning to Invest in Trade245? Read These Negative Trader Reviews First!

Setting your sights on Trade245? Think again! Traders are witnessing massive problems that extend beyond withdrawal denials. The issues include blown-up accounts due to trading manipulation, along with high spreads and commissions. As a result, traders witness only losses even when they are not supposed to. This has made the situation highly complicated for them. In this article, we have exposed Trade245 for its financially illicit acts. Read on!

Zerodha Scam: Investor Loses ₹3.5 Lakh ! Spot the Red Flags & Protect Yourself

Indian investor Maryam Khan, 35, was scammed out of nearly ₹35 Lakh in a fraudulent stock investment scheme orchestrated by individuals impersonating the legitimate financial firm Zerodha. The scam began when Khan came across a Facebook Reel on July 4 promoting fake investment opportunities. After contacting the WhatsApp number listed in the ad,

Scam Alert: GTS Caught in Major Trading Fraud

Have you been deceived by GTS officials? Has this forex broker prevented you from withdrawing funds? Unfortunately, you have been scammed! File a complaint with the authorities soon to recover your funds. Many have accused this forex broker of serious fraud allegations on several broker review platforms. Our WikiFX team found a massive number of trader complaints against this broker. In this article, we will share them with you.

Best 5 Low-Spread FX Brokers in India 2025

Forex trading has grown rapidly in India, and choosing the right broker is critical—especially when it comes to spreads. A low spread broker means lower trading costs and higher potential profits, especially for active traders and scalpers. In this article, we list the top 5 low-spread forex brokers in India for 2025, trusted for their tight spreads, fast execution, and strong global reputation.

WikiFX Broker

Latest News

Datuk Seri Linked to RM8.4 Million Gold Investment Scam Under Police Probe

The Psychology Behind the Ascending Triangle Pattern in Forex

Charles Schwab Forex Review 2025: What Traders Should Know

The Global Inflation Outlook

What WikiFX Found When It Looked Into XS

ASIC Regulated Forex Brokers: A Comprehensive 2025 Guide

Is TradeEU Reliable in 2025?

Professional Forex Trading: Skills, Tools, & Strategies for Success

Investing in OnFin? Absurd Withdrawal Conditions & Trade Manipulation May Spoil Your Trading Mood

How Commodity Prices Affect Forex Correlation Charts

Currency Calculator