简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXGT.com: A Closer Look at Its Licences

Abstract:In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about FXGT.com and its licenses.

If youre thinking about trading online, choosing a broker with the right licences is very important. A licence means the broker is being watched by financial authorities and must follow rules to protect traders.

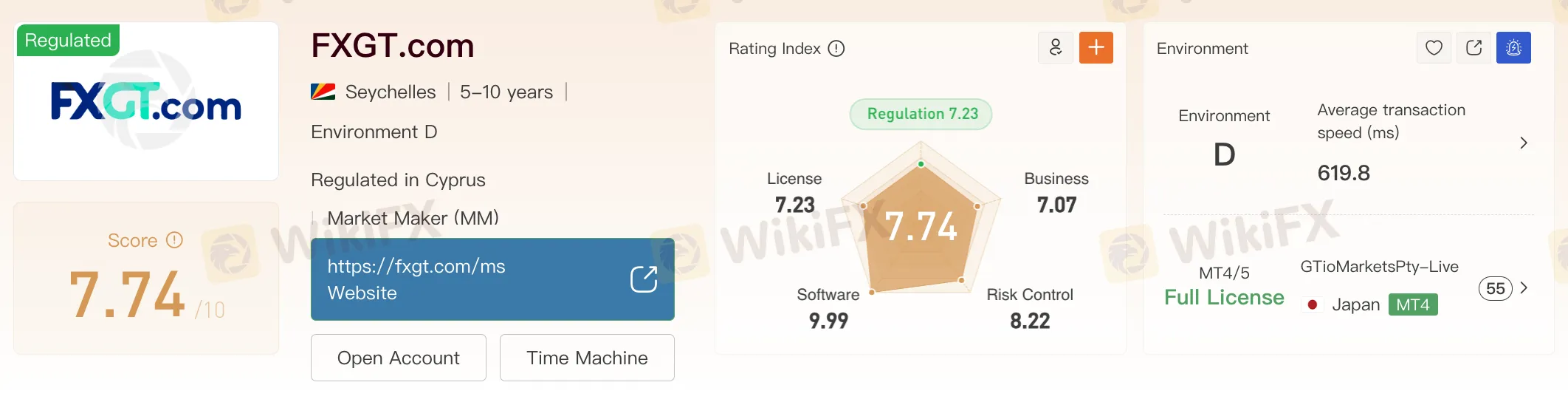

FXGT.com is one broker thats getting more attention. According to WikiFX, a platform that checks broker safety and licences, FXGT.com has a WikiScore of 7.74 out of 10. This score is based on several things, like how the company is regulated, how it runs, and how safe it is for users.

FXGT.com has four licences from different countries. The most trusted one is from the Cyprus Securities and Exchange Commission (CySEC). The licence number is 382/20. CySEC is a respected European regulator. This means FXGT.com has to follow strict rules, especially for clients in Europe. Under this licence, FXGT.com is a Market Maker, which means it can take the other side of your trade. This is normal, but its something traders should know.

The company is also licensed in Seychelles by the Financial Services Authority (FSA) with licence number SD019, and in Vanuatu by the Financial Services Commission, licence number 700601. These are known as offshore licences. They allow the broker to offer services worldwide, but the rules in these places are not as strong. If you trade under one of these offshore licences, you might not have the same level of protection as in Europe.

FXGT.com also holds a licence in South Africa, issued by the Financial Sector Conduct Authority (FSCA). The licence number is 48896. The FSCA is a recognised financial regulator in Africa and gives some oversight, but its rules are not as strict as those in Europe.

So, what does all this mean?

FXGT.com is licensed in several places. Its licence from CySEC is a strong point, showing that it meets high standards in Europe. The other licences, in Seychelles, Vanuatu, and South Africa, give the broker the ability to work with clients around the world, but they offer different levels of safety.

The WikiScore of 7.74 means FXGT.com is doing fairly well in areas like regulation, software, and risk control. However, traders should still be careful. Always check which licence applies to you and what it means for your protection.

In short, FXGT.com seems to be a reliable broker, but not all licences are equal. Make sure you understand where the broker is licensed and how that affects your safety. A little research now can save you from big problems later.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

SmartFX Exposed: 4 Warning Signs Traders Can’t Ignore

Facing losses due to manipulative forex trading that takes centre stage at SmartFX? Move out of this ship before it sinks and leaves you with virtually no capital on hand. In this article, we will expose SmartFX by showcasing its four red flags that traders like you cannot ignore.

Is India-Based Groww an Investment Scam? 5 Truths to Know

Groww is an India-based broker that is gaining popularity rapidly in the country. You will often see its ads on YouTube and other social media platforms. This broker is promoting itself aggressively. But before you invest with this broker, here are 5 red flags you should know.

A Guide to Backtesting Forex Trading Strategies

As one of the most liquid and widely traded markets globally, the forex market offers traders immense earning opportunities. However, currency trading can present risks too because you may trade leveraged positions, potentially resulting in significant losses should things go wrong. Backtesting forex trading strategies before investing in a strategy is crucial. Should you fail to test it, you may end up risking time and capital on a strategy that doesn’t hold an edge. In this article, we will discuss backtesting a forex trading strategy. Read on!

Datuk Seri Linked to RM8.4 Million Gold Investment Scam Under Police Probe

Malaysian police are investigating a gold investment scam that has cheated 37 people out of more than RM8.4 million, with a businessman holding the honorific title ‘Datuk Seri’ believed to be the mastermind.

WikiFX Broker

Latest News

Datuk Seri Linked to RM8.4 Million Gold Investment Scam Under Police Probe

The Psychology Behind the Ascending Triangle Pattern in Forex

Charles Schwab Forex Review 2025: What Traders Should Know

The Global Inflation Outlook

What WikiFX Found When It Looked Into XS

ASIC Regulated Forex Brokers: A Comprehensive 2025 Guide

Revealing the Art of Forex Spread Betting

EC Markets Enters Mexico City, Accelerates LATAM Push

Scam Warning from NZ FMA: Beware of Unauthorised Firms

Top CMA-Regulated Forex Brokers in Kenya 2025

Currency Calculator