简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

eToro Expands into Singapore with MAS CMS Licence

Abstract:eToro has officially expanded its services to Singapore after receiving and activating its Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS), the company announced today, July 16, 2025.

eToro has officially expanded its services to Singapore after receiving and activating its Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS), the company announced today, July 16, 2025.

What the MAS Licence Means for Singapore Investors

With its CMS licence now in force, eToro can offer eligible retail investors in Singapore access to:

Stocks from more than 20 of the worlds leading stock exchanges

Exchange-traded funds (ETFs) spanning global markets

Derivatives, including CFDs on indices, commodities, and more

All of these products will be available through eToros award‑winning social investing platform, empowering users to trade, share, and learn in a single, intuitive interface.

Following our report in May that eToro had tapped ABN Amro and Essence Group alum Yaki Razmovich to head its new Asia hub in Singapore, Razmovich officially took the reins of the Singapore operation earlier this year. He will oversee the build‑out of eToros regional franchise and drive further expansion across Asia Pacific

About eToro

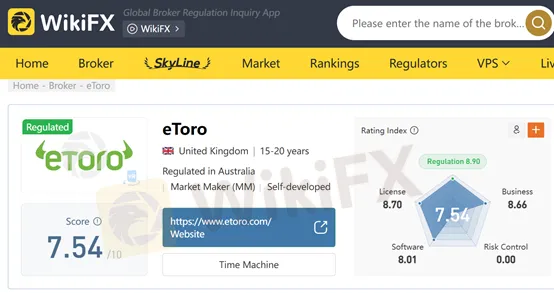

Founded in 2007, over the years, eToro has grown to support millions of registered users worldwide, offering a diverse range of financial instruments, including forex, stocks, ETFs, cryptocurrencies, and commodities. According to WikiFX, eToro holds a solid compliance and reliability rating, reflecting its commitment to regulatory standards and customer protection. For more information about this broker, you can go to WikiFX and search for yourself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

5 Cons of DB Investing Broker You Must Know

It's always advisable to read online review articles about forex brokers you are thinking to Invest your money with. The forex market has become increasingly unsafe due to the rise of fraudulent brokers. Review articles help you spot scam brokers and protect your money. Read this important article about DB Investing to stay fraud alert.

iForex - Where Withdrawal Denials, High Spread & Scams Spoil Your Forex Trading Mood

Are high spreads charged by iForex disallowing you to make profits? Do you feel that you will never be able to withdraw from iForex? It's nothing new! Read this exposure story where we have highlighted complaints from several investors.

Forex Hedging Strategies - Calming You Amid Market Chaos

Finding it hard to deal with the forex market volatility? Do those ups and downs in currency pair prices make you more nervous or worried? You need the right forex hedging strategies. As a concept, forex hedging is about strategically opening additional positions to stay immune against adverse forex price movements. It’s about offsetting or balancing your current positions by buying or selling financial instruments. As a trader, your risk exposure is reduced, hence limiting your potential losses.

Scam Alert: Cloned Broker Scams on the Rise

Reputed authorities like the FCA have issued warnings against brokers who act genuine but are actually fake brokers. They copy details such as logos, names, branding, and sometimes even employee appearances to trick investors and steal money from them.

WikiFX Broker

Latest News

Forex Hedging Strategies - Calming You Amid Market Chaos

Key Events This Week: ISM, Trade Balance And More Earnings

What Is Forex Currency Trading? Explained Simply

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

A Beginner’s Guide to Trading Forex During News Releases

Ultima Markets enters the UK and gains the FCA license

LSEG Announces £1 Billion Share Buyback Program

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

Scam Alert: Cloned Broker Scams on the Rise

TradersWay Broker Review 2025: Unregulated Status and Global Warnings You Shouldn’t Ignore

Currency Calculator