简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What WikiFX Found When It Looked Into CORSA FUTURES

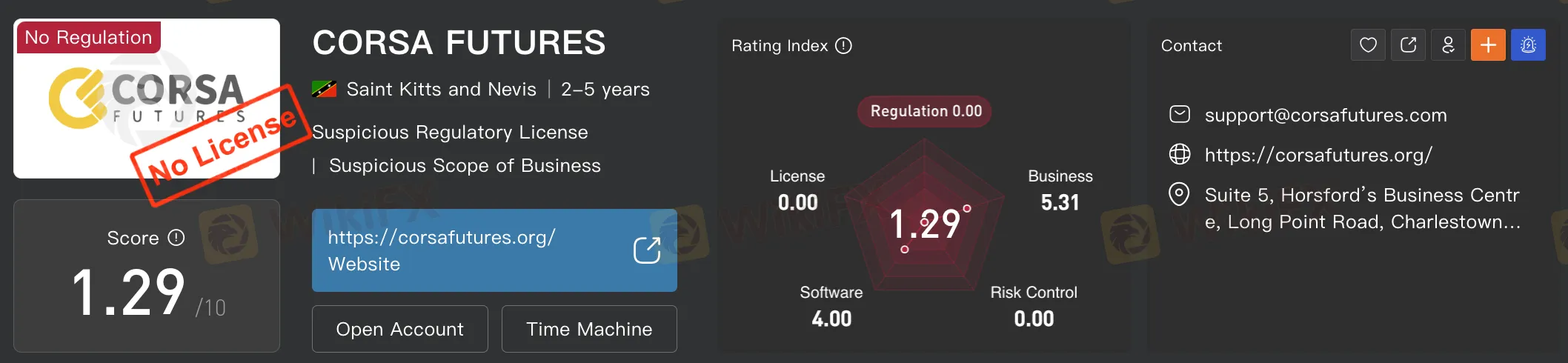

Abstract:Online trading is growing fast, but so are the risks. It's more important than ever to choose brokers that are transparent, regulated, and trustworthy. One broker raising concerns is CORSA FUTURES. According to WikiFX, a platform that checks broker credibility, CORSA FUTURES has a very low score of 1.29 out of 10. This low rating suggests serious issues with the broker's trustworthiness. Keep reading to learn more about this broker

Online trading is growing fast, but so are the risks of forex scams. It's more important than ever to choose brokers that are transparent, regulated, and trustworthy. One broker raising concerns is CORSA FUTURES. According to WikiFX, a platform that checks broker credibility, CORSA FUTURES has a very low score of 1.29 out of 10. This low rating suggests serious issues with the broker's trustworthiness and increases the risk of falling victim to a forex scam.

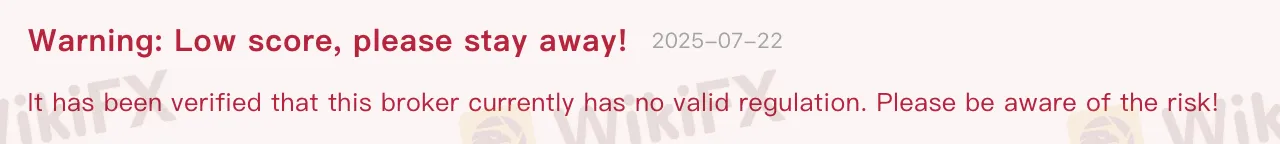

One major concern is that CORSA FUTURES is not regulated. This has been confirmed by independent sources. Regulation is essential because it protects traders. It makes sure brokers follow fair rules, keep client funds safe, and offer ways to resolve problems.

Without a proper license, CORSA FUTURES operates outside of these protections. This can lead to problems like unauthorized charges, slow or blocked withdrawals, and no clear way to handle complaints, which are classic signs of forex scams.

CORSA FUTURES is registered in Saint Kitts and Nevis, a small offshore location known for having weak financial rules. While it's legal to register there, these places usually dont require brokers to follow strict standards. This can mean poor fund protection, low transparency, and more risk of forex scams.

Where a broker is based matters. Offshore registration is often a warning sign. In this case, it adds to the suspicion that CORSA FUTURES may be linked to forex scam activity.

The low WikiScore of 1.29/10 reflects several problems, including a lack of regulation, negative customer feedback, poor software, and weak risk management. This score shows that the broker is not seen as reliable and may be engaging in forex scams.

Some traders have also reported issues like not getting their money back and unhelpful support. These are common complaints in known forex scams.

CORSA FUTURES shows multiple warning signs: no license, offshore registration, low scores, and negative feedback. While not every unregulated broker is a scam, these issues combined make CORSA FUTURES a high-risk choice.

To protect your money, always choose brokers that are regulated by trusted authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Unregulated brokers can lead to big losses, with little chance of recovery.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

5 Cons of DB Investing Broker You Must Know

It's always advisable to read online review articles about forex brokers you are thinking to Invest your money with. The forex market has become increasingly unsafe due to the rise of fraudulent brokers. Review articles help you spot scam brokers and protect your money. Read this important article about DB Investing to stay fraud alert.

iForex - Where Withdrawal Denials, High Spread & Scams Spoil Your Forex Trading Mood

Are high spreads charged by iForex disallowing you to make profits? Do you feel that you will never be able to withdraw from iForex? It's nothing new! Read this exposure story where we have highlighted complaints from several investors.

Forex Hedging Strategies - Calming You Amid Market Chaos

Finding it hard to deal with the forex market volatility? Do those ups and downs in currency pair prices make you more nervous or worried? You need the right forex hedging strategies. As a concept, forex hedging is about strategically opening additional positions to stay immune against adverse forex price movements. It’s about offsetting or balancing your current positions by buying or selling financial instruments. As a trader, your risk exposure is reduced, hence limiting your potential losses.

Scam Alert: Cloned Broker Scams on the Rise

Reputed authorities like the FCA have issued warnings against brokers who act genuine but are actually fake brokers. They copy details such as logos, names, branding, and sometimes even employee appearances to trick investors and steal money from them.

WikiFX Broker

Latest News

What Is Forex Currency Trading? Explained Simply

LSEG Announces £1 Billion Share Buyback Program

Ultima Markets enters the UK and gains the FCA license

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

A Beginner’s Guide to Trading Forex During News Releases

Forex Hedging Strategies - Calming You Amid Market Chaos

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

Key Events This Week: ISM, Trade Balance And More Earnings

Think Uncle Sam Owes $37 Trillion? It's Far Worse Than That

SkyLine Judge Community: Appreciation Dinner Successfully Held in Malaysia

Currency Calculator