简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exposing Profit Trade: Profit Only Exists in Its Name, Not During Trade

Abstract:If there was ever a forex scammer to be alert of, Profit Trade emerges as the first one. The Bulgaria-based forex broker has been annoying investors by denying their withdrawal requests, suspending their account without any reason, and unfulfilled promises.

If there's one forex scammer to watch out for, it's Profit Trade. The Bulgaria-based forex broker has been annoying investors by denying their withdrawal requests, suspending their account without any reason, and unfulfilled promises. As lots of investors took to the forex review website to complain about the illegitimate ploys used by Profit Trade, we thought about sharing their pains, opinions, and, importantly, losses. Lets read on!

Top Investor Complaints About Profit Trade

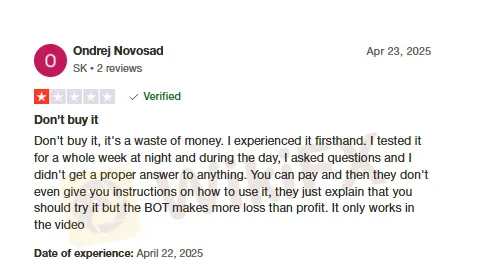

No Trading Instructions, No Query Resolution, Only Losses

Imagine how tough it would be for a forex trader to navigate the seemingly complex graphs to decide on strategic investment calls. It happens at Profit Trade. While on Profit Trade Login, investors tend to get confused and call for help. However, its executives fail to answer key customer queries. As a result, investors face losses. Here is one complaint regarding it.

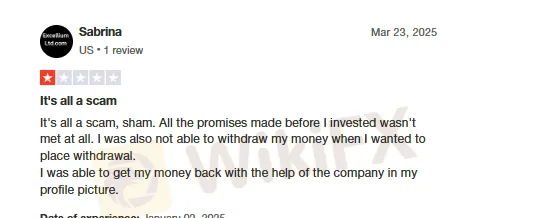

Account Suspension Further Adds to the Misery for Investors

How about this one? Surely, a shocker for the investor who, despite following the process diligently, had to deal with an account suspension. The investor is calling Profit Trade a scam, loud and clear! Check out the words.

Unfulfilled Promises, Withdrawal Request Denials

Profit Trade often acquires customers using tall promises. But when the time comes to fulfill them, they turn their back! Even worse is the denial of withdrawal requests made by the investor on Profit Trade login. Check out the complaint to understand the real concern of this investor.

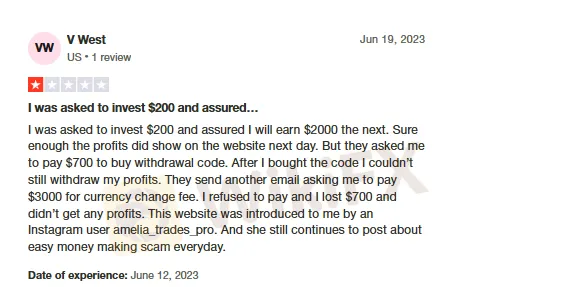

Profit Manipulation, Additional Fee for Withdrawal, Currency Change Fee Demand

Promising exorbitant returns on investments, manipulating profit figures, imposing additional fee charges to buy withdrawal codes, and demanding currency change fees define Profit Trade. Eventually, the investor gets nothing! Here are the words, evoking pain and frustration over the poor customer service.

Why Profit Trade is Not a Forex Broker to Partner with

Profit Trade is not a reliable forex broker because it is not licensed by any of the competent financial authorities. So, it is relieved from disclosing everything about its operations to the regulator. These can even include the problems the company faces regarding profit and liquidity, the forex schemes, the shareholding pattern, and more. Unapproved brokers, such as Profit Trade, can always commit a scam. The investor complaint snapshots made above are proof. Considering the increasing red flags, we at WikiFX, the leading broker regulation inquiry app, have assigned it a poor score of 1.56 out of 10.

Join the WikiFX Masterminds Community to know what's trending on forex.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

5 Cons of DB Investing Broker You Must Know

It's always advisable to read online review articles about forex brokers you are thinking to Invest your money with. The forex market has become increasingly unsafe due to the rise of fraudulent brokers. Review articles help you spot scam brokers and protect your money. Read this important article about DB Investing to stay fraud alert.

iForex - Where Withdrawal Denials, High Spread & Scams Spoil Your Forex Trading Mood

Are high spreads charged by iForex disallowing you to make profits? Do you feel that you will never be able to withdraw from iForex? It's nothing new! Read this exposure story where we have highlighted complaints from several investors.

Forex Hedging Strategies - Calming You Amid Market Chaos

Finding it hard to deal with the forex market volatility? Do those ups and downs in currency pair prices make you more nervous or worried? You need the right forex hedging strategies. As a concept, forex hedging is about strategically opening additional positions to stay immune against adverse forex price movements. It’s about offsetting or balancing your current positions by buying or selling financial instruments. As a trader, your risk exposure is reduced, hence limiting your potential losses.

Scam Alert: Cloned Broker Scams on the Rise

Reputed authorities like the FCA have issued warnings against brokers who act genuine but are actually fake brokers. They copy details such as logos, names, branding, and sometimes even employee appearances to trick investors and steal money from them.

WikiFX Broker

Latest News

What Is Forex Currency Trading? Explained Simply

LSEG Announces £1 Billion Share Buyback Program

Ultima Markets enters the UK and gains the FCA license

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

A Beginner’s Guide to Trading Forex During News Releases

Forex Hedging Strategies - Calming You Amid Market Chaos

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

Key Events This Week: ISM, Trade Balance And More Earnings

SkyLine Judge Community: Appreciation Dinner Successfully Held in Malaysia

Think Uncle Sam Owes $37 Trillion? It's Far Worse Than That

Currency Calculator