简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Olymptrade Under Fire – Fraud Allegations and Investor Outrage

Abstract:The message is loud and clear for Olymptrade - Get your act RIGHT or continue to face fraud allegations and investor outrage. With investor complaints refusing to stop, Olymptrade has all but lost trust and goodwill.

The message is loud and clear for Olymptrade - Get your act RIGHT or continue to face fraud allegations and investor outrage. With investor complaints refusing to stop, Olymptrade has all but lost trust and goodwill. The company has allegedly accumulated wealth through questionable practices. Complaints have been around illegitimate account blockage, frequent withdrawal denials, and the apparent losses for investors. Let us share their complaints.

Top Trading Issues Faced at Olymptrade

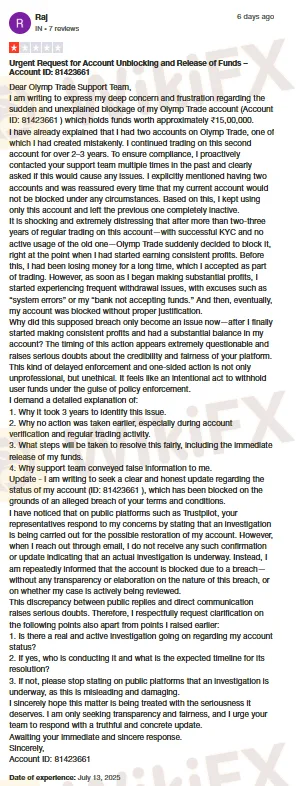

Accounts Get Blocked When Profits Appear

Surprisingly true is this fact. When trading losses take place, customers have their accounts running. The moment the account starts to show profits and makes investors request withdrawals, the company officials block it to trap their wealth. While profits and losses are part of the forex trading game, accounts should remain active in any of these two cases. This did not remain the case with an investor who wrote a long and bad review of Olymptrade. Here is the review.

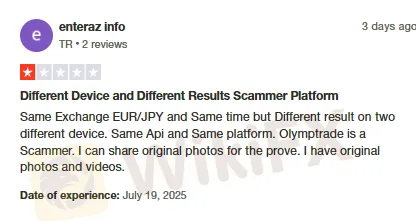

Different Device, Different Results - Hows That POSSIBLE?

It is possible at Olymptrade, which scams investors using strange tactics. These even include manipulating data on different devices. In contrast, when you trade with a genuine forex broker, the results will remain uniform across devices. A strange but true scam unfolded through this comment.

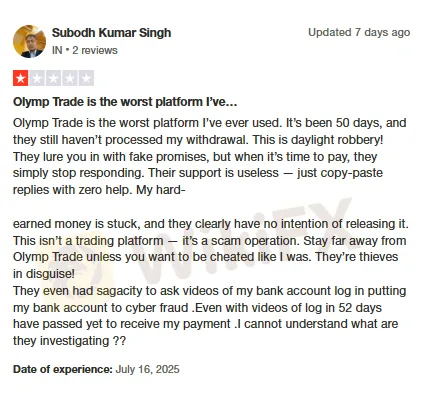

Only Fake Promises, No Withdrawals

Acquiring investors through fake return promises is increasingly becoming the routine for Olymptrade. But what about withdrawals? Nothing much to talk about! Withdrawal requests do not get approved even after 50 days, showcasing poor customer service. A screenshot showing this complaint is right below. Take a look.

The Biggest Reason Why You Should Avoid Trading with Olymptrade

The Vanuatu-based forex broker does not hold a valid license to operate a forex business. Imagine the numerous customers it would have scammed since its inception. The worst part about unlicensed brokers such as Olymptrade is the lack of transparency and safety, which remain the strength of reliable forex brokers. With Olymptrade, expect only scams and losses. Thats why WikiFX, the go-to forex broker regulation inquiry app, has assigned it a score of 1.67 out of 10.

You can also join WikiFX Masterminds - Where Forex Intellectuals Meet and Share Game-changing Forex Trading Insights

Scan this QR code to join.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

5 Cons of DB Investing Broker You Must Know

It's always advisable to read online review articles about forex brokers you are thinking to Invest your money with. The forex market has become increasingly unsafe due to the rise of fraudulent brokers. Review articles help you spot scam brokers and protect your money. Read this important article about DB Investing to stay fraud alert.

iForex - Where Withdrawal Denials, High Spread & Scams Spoil Your Forex Trading Mood

Are high spreads charged by iForex disallowing you to make profits? Do you feel that you will never be able to withdraw from iForex? It's nothing new! Read this exposure story where we have highlighted complaints from several investors.

Forex Hedging Strategies - Calming You Amid Market Chaos

Finding it hard to deal with the forex market volatility? Do those ups and downs in currency pair prices make you more nervous or worried? You need the right forex hedging strategies. As a concept, forex hedging is about strategically opening additional positions to stay immune against adverse forex price movements. It’s about offsetting or balancing your current positions by buying or selling financial instruments. As a trader, your risk exposure is reduced, hence limiting your potential losses.

Scam Alert: Cloned Broker Scams on the Rise

Reputed authorities like the FCA have issued warnings against brokers who act genuine but are actually fake brokers. They copy details such as logos, names, branding, and sometimes even employee appearances to trick investors and steal money from them.

WikiFX Broker

Latest News

What Is Forex Currency Trading? Explained Simply

LSEG Announces £1 Billion Share Buyback Program

Ultima Markets enters the UK and gains the FCA license

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

A Beginner’s Guide to Trading Forex During News Releases

Forex Hedging Strategies - Calming You Amid Market Chaos

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

SkyLine Judge Community: Appreciation Dinner Successfully Held in Malaysia

Think Uncle Sam Owes $37 Trillion? It's Far Worse Than That

iForex - Where Withdrawal Denials, High Spread & Scams Spoil Your Forex Trading Mood

Currency Calculator