简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Spanish Regulator, CNMV Alerts Investors against 11 Scam Brokers

Abstract:Spain’s Financial regulator, CNMV (Comisión Nacional del Mercado de Valores) CNMV has issued warnings against 11 forex brokers operating without proper authorization.

Spains financial regulator, CNMV (Comisión Nacional del Mercado de Valores) CNMV has issued warnings against 11 forex brokers operating without proper authorization.

List of 11 Scam Brokers

1. Gain Wheal Funds / Gain Wheal Funds Limited

2. EliteGlobalFx

3. TrustFxPro

4. Zenith Global Venture

5. Ai-MiningEx / Ai-Mining Exchange

6. NetWealth

7. Meta-stock Traders

8. Dynasty Trade

9. Pairs Exchange

10. Stream Capital invest

11. Clusive Finance

Why You Should Take this Warning Seriously?

The CNMVs Warning List identifies firms operating without proper authorisation, meaning they are not regulated by the CNMV. Engaging with such unauthorised firms exposes you to significant risks, including:

1. Lack of Legal Protections: If things go wrong, you may have no legal recourse, as these firms are outside the reach of national regulatory systems.

2. Increased Risk of Fraud: Unregulated platforms are more likely to manipulate trades, delay withdrawals, or simply disappear with your funds.

3. Potential Financial Loss: Many traders have lost large sums of money by trusting unlicensed brokers that offered high returns or bonus traps.

Ways to Protect Your Money from Fraudulent Brokers

If you're involved in forex trading, it's essential to know how to protect your funds and avoid falling victim to fraud. Here are five important tips to help you stay safe.

If you're active in forex trading, it's vital to protect your investment. Here are five essential tips to stay safe:

1. Choose a Regulated Broker:

Always ensure your broker is licensed by a recognized regulatory authority such as CNMV, FCA (UK), or CySEC (Cyprus).

2. Verify the Brokers Reputation:

Read user reviews, check industry forums, and do your research before signing up.

3. Be Wary of Unrealistic Promises:

Offers that sound “too good to be true” usually are. Avoid brokers guaranteeing profits or high bonuses.

4. Avoid Unsolicited Offers:

Ignore cold calls, emails, or social media messages urging you to invest urgently.

5. Understand the Terms and Conditions:

Carefully read withdrawal rules, bonus policies, and trading terms to avoid hidden traps.

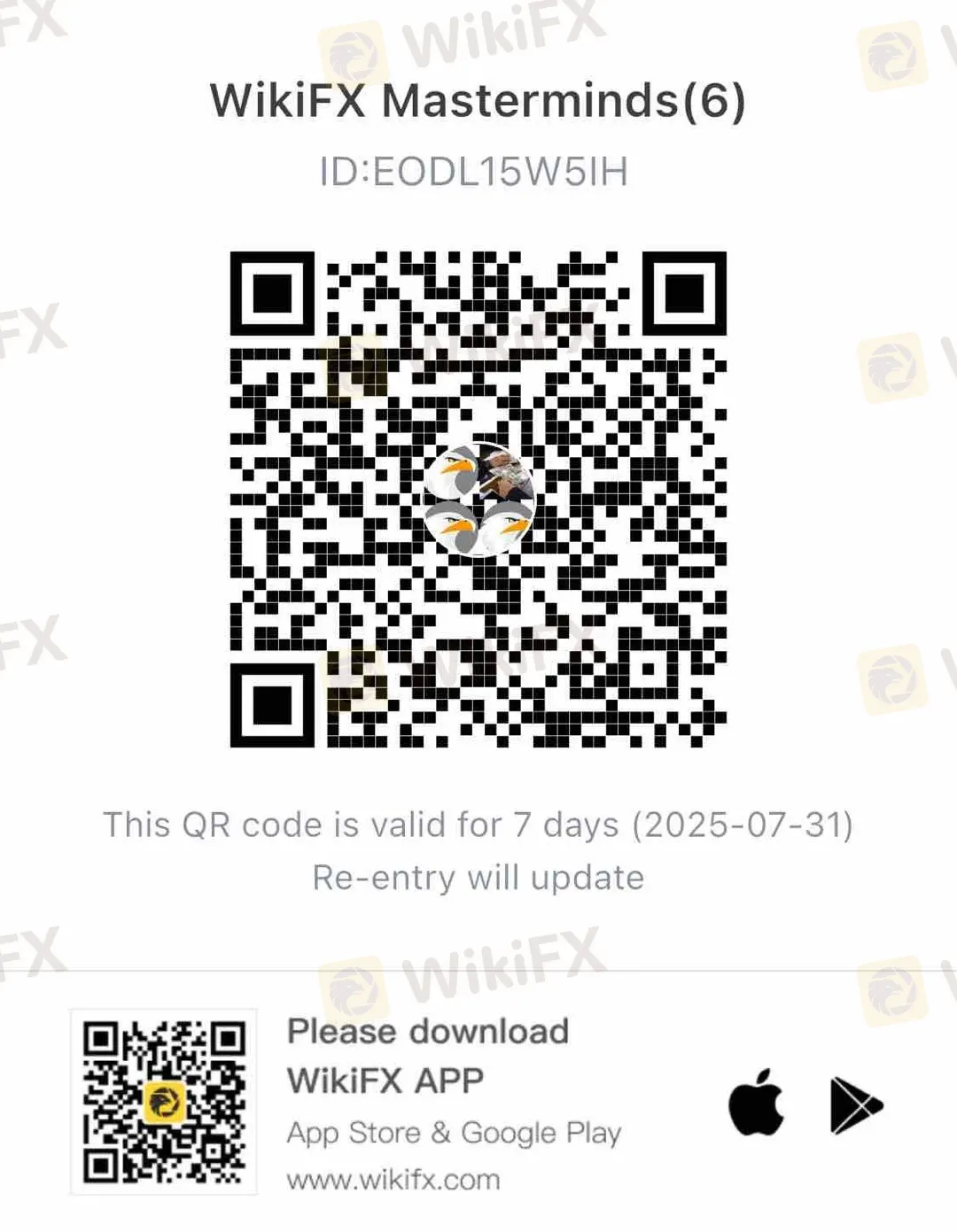

Join WikiFX Community

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. Congratulations! You have Joined the Group

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

5 Cons of DB Investing Broker You Must Know

It's always advisable to read online review articles about forex brokers you are thinking to Invest your money with. The forex market has become increasingly unsafe due to the rise of fraudulent brokers. Review articles help you spot scam brokers and protect your money. Read this important article about DB Investing to stay fraud alert.

iForex - Where Withdrawal Denials, High Spread & Scams Spoil Your Forex Trading Mood

Are high spreads charged by iForex disallowing you to make profits? Do you feel that you will never be able to withdraw from iForex? It's nothing new! Read this exposure story where we have highlighted complaints from several investors.

Forex Hedging Strategies - Calming You Amid Market Chaos

Finding it hard to deal with the forex market volatility? Do those ups and downs in currency pair prices make you more nervous or worried? You need the right forex hedging strategies. As a concept, forex hedging is about strategically opening additional positions to stay immune against adverse forex price movements. It’s about offsetting or balancing your current positions by buying or selling financial instruments. As a trader, your risk exposure is reduced, hence limiting your potential losses.

Scam Alert: Cloned Broker Scams on the Rise

Reputed authorities like the FCA have issued warnings against brokers who act genuine but are actually fake brokers. They copy details such as logos, names, branding, and sometimes even employee appearances to trick investors and steal money from them.

WikiFX Broker

Latest News

Forex Hedging Strategies - Calming You Amid Market Chaos

Key Events This Week: ISM, Trade Balance And More Earnings

What Is Forex Currency Trading? Explained Simply

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

A Beginner’s Guide to Trading Forex During News Releases

Ultima Markets enters the UK and gains the FCA license

LSEG Announces £1 Billion Share Buyback Program

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

SkyLine Judge Community: Appreciation Dinner Successfully Held in Malaysia

Interactive Brokers: A Closer Look at Its Licenses

Currency Calculator