简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How about Assexmarkets Trading Accounts and Fees?

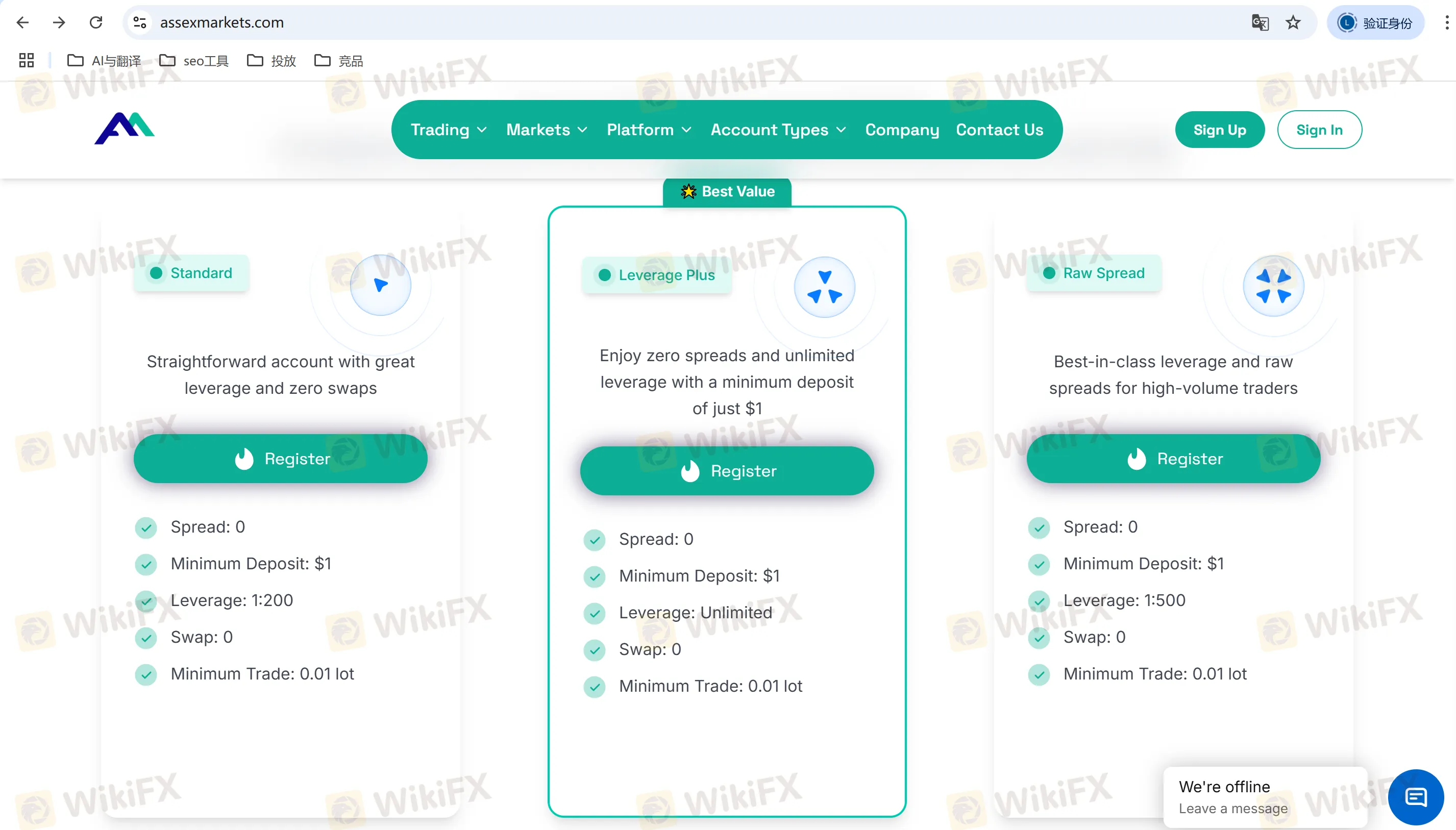

Abstract:Assexmarkets offers multiple account types to cater to different trading preferences. These include Standard, Standard Cent, Pro (Professional), Zero, Raw Spread, Social Pro, and Portfolio Management accounts. Each account type has its own minimum deposit requirement, leverage options, and features. Traders can choose between different account types based on their trading style, with options for Islamic accounts, demo accounts, and high leverage.

Assexmarkets offers multiple account types to cater to different trading preferences. These include Standard, Standard Cent, Pro (Professional), Zero, Raw Spread, Social Pro, and Portfolio Management accounts. Each account type has its own minimum deposit requirement, leverage options, and features. Traders can choose between different account types based on their trading style, with options for Islamic accounts, demo accounts, and high leverage.

Account Types

| Account Type | Minimum Deposit | Leverage | Spread from | Commission |

| Standard | $1 | 1:Unlimited | 0.2 pips | No commission |

| Standard Cent | Depends on payment system | 1:Unlimited | 0.3 pips | No commission |

| Pro (Professional) | $500 | 1:Unlimited | 0.1 pips | No commission |

| Zero | $500 | 1:Unlimited | 0 pips | From $0.05 |

| Raw Spread | $500 | 1:Unlimited | 0.1 pips | Up to $3.50/lot |

| Social Pro | $500 | 1:200 | 0.6 pips | No commission |

| Portfolio Management | / | 1:200 | 0.4 pips | No commission |

What Are the Trading Fees at Assexmarkets?

Assexmarkets offers competitive trading fees, with spreads starting from 0.2 pips on the Standard account. The broker does not charge commission for most account types, except for the Zero and Raw Spread accounts. Additionally, there are no swap fees or withdrawal fees, and the platform provides a bonus structure for eligible traders.

Trading Fees

| Fee Type | Amount |

| Minimum Spread | 0.2 pips (Standard) |

| Commission | From $0.05 (Zero) |

| Swap Fees | None |

| Bonus | / |

For details on deposit and withdrawal fees, please refer to the deposit/withdrawal page.

FAQ: What You Want to Know Most

Q1: Does Assexmarkets charge commissions?

A1: Yes, commissions apply to Zero and Raw Spread accounts. Other account types, such as Standard and Pro, do not charge any commissions.

Q2: Are the spreads at Assexmarkets high or low?

A2: Assexmarkets offers competitive spreads, starting from 0.2 pips on the Standard account, which is lower than the industry average.

Q3: Does Assexmarkets offer demo accounts?

A3: Yes, Assexmarkets offers demo accounts to help traders familiarize themselves with the platform before trading with real money.

Q4: What account types does Assexmarkets offer?

A4: Assexmarkets offers a variety of account types, including Standard, Pro, Zero, Raw Spread, Social Pro, and Portfolio Management accounts.

Q5: Does Assexmarkets offer an Islamic account?

A5: Yes, Assexmarkets provides Islamic accounts, catering to traders who require a Sharia-compliant trading environment.

Q6: What is the maximum leverage at Assexmarkets?

A6: Assexmarkets offers a maximum leverage of up to 1:500, providing traders with greater flexibility to manage larger positions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FCA Issues New Alerts Against Unlicensed Financial Platforms, Including Clone Scams

FCA Forex Trading Regulations Explained – What Every Trader and Broker Must Know

FIBO Group: A Closer Look at Its Licenses

Making Money with Forex Weekend Trading

Scam Alert: FCA Issued Warning! Check the List of Unauthorized Brokers Below!

Forex Success Stories: Lessons You Can Use to Win

Euro zone inflation holds steady at higher-than-expected 2% in July

The Untold Story In Today's Jobs Report: The Unprecedented Purge Of Illegal Alien Workers

What are Indian Traders saying about MINTCFD?

Think Uncle Sam Owes $37 Trillion? It's Far Worse Than That

Currency Calculator