简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Quotex Broker Review 2025: Is It a High-Risk Broker?

Abstract:Quotex Review 2025: Unregulated binary options broker with numerous withdrawal complaints and warnings. Read this in-depth risk analysis before depositing.

Introduction

Quotex markets itself as a fast, user-friendly platform for binary options across forex, crypto, indices, metals, and energy, attracting global traders with low $10 minimums and web, desktop, and mobile access. Yet beneath the sleek interface lies a deeper risk profile: Quotex is not authorized by any major financial regulator, and complaint volumes about account suspensions and blocked withdrawals have surged into 2025. This review compiles verifiable evidence to assess whether Quotex is a high‑risk broker.

At a glance: What Quotex claims vs. what we found

- Products and access: Digital/binary options on multiple asset classes via proprietary WebTrader and mobile apps; demo accounts available; low minimum deposit around $10.

- Corporate/registration: Reported offshore registrations (e.g., Saint Vincent and the Grenadines/Seychelles) and operation without supervision by a recognized financial authority.

- Regulatory and public warnings: Not authorized by major regulators; subject to warnings from European authorities (e.g., CONSOB and CMVM) regarding unauthorized investment services.

- Complaints trend: Dozens of reports in 2024–2025 of frozen accounts, failed withdrawals, and altered/blocked trading, documented on third‑party watchdog platforms.

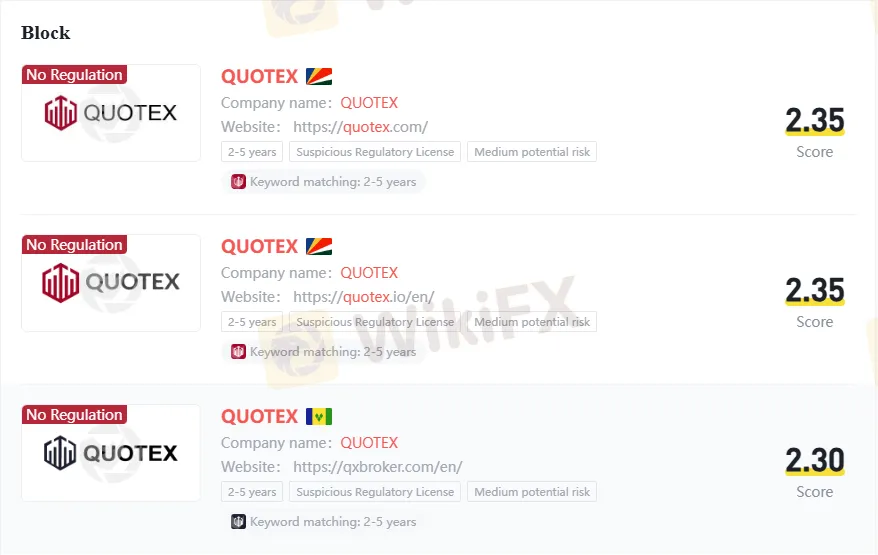

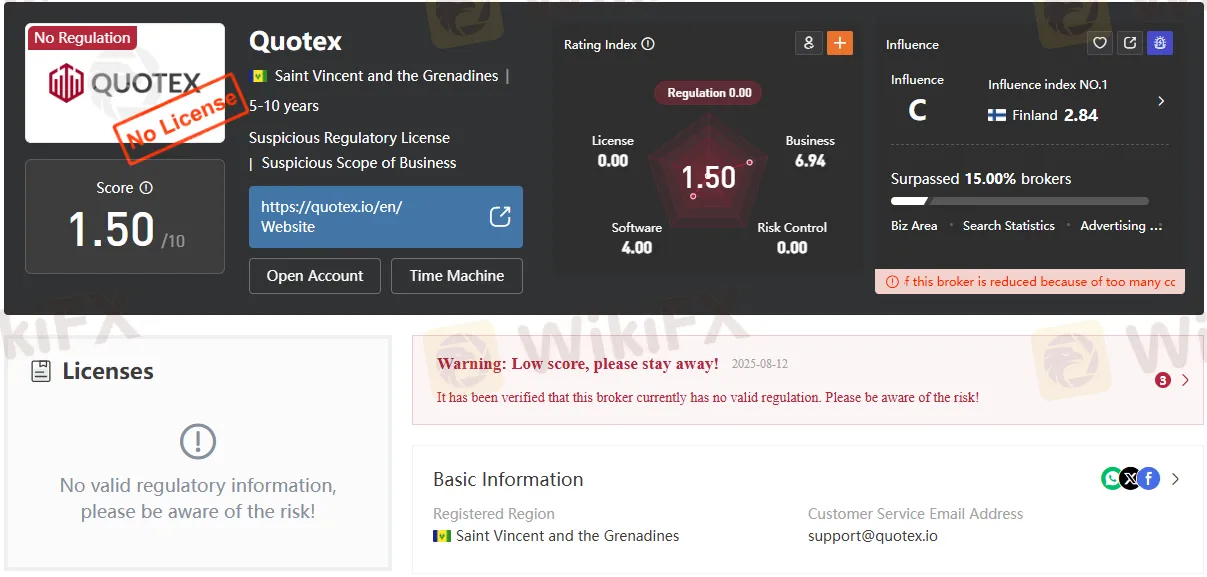

Regulatory status: Unregulated and warned against

Quotex “has not been authorized or regulated by any major financial regulatory body,” according to a 2025 watchdog review that also notes its offshore setup in Saint Vincent and the Grenadines where there is no effective oversight of forex/derivatives activity. European regulators have issued public warnings: Italy‘s CONSOB published an alert in December 2021 for offering services without required authorizations, and Portugal’s CMVM warned in January 2023 that Quotex is not authorized to provide financial intermediation in Portugal. These factors establish a clear “unregulated” status with added jurisdictional risk for client protection and recourse.

Platform, instruments, and terms

Quotex offers a proprietary web-based platform and mobile apps with binary options across forex pairs, stock indices, select cryptocurrencies, metals, and energies, with payouts commonly marketed up to the mid‑90% range depending on asset and expiry. It promotes quick onboarding, free demo balances, and small minimum deposits that lower entry barriers for new traders. While such accessibility is attractive, binary options are inherently high-risk due to all‑or‑nothing payoff structures and short expiries, and the absence of regulation compounds counterparty risk.

Complaints and risk signals in 2024–2025

Independent complaint boards and broker vetting sites show a pattern that intensified into 2025: accounts suspended once profitable, withdrawals delayed or denied, and communication lapses from support. One 2025 case report describes an account suspension during withdrawal after growing a balance to $43,000, alleging the broker “allows losses but blocks profitable accounts”. A consolidated exposure page documents users citing altered charts, emptied balances, and inability to confirm emails to process withdrawals during April 2025 incidents. Watchdog coverage in February 2025 states more than 40 complaints and emphasizes recurring withdrawal blocks as the “biggest problem” highlighted by traders. These reports are consistent with broader “unregulated/high‑risk” red flags.

Mixed public reviews vs. verifiable risks

Some directories and user forums include positive experiences about fast withdrawals, responsive support, and easy UI, reflecting that not every customer reports harm and that short‑term usage can appear smooth. However, positive testimonials do not offset the structural risk created by the lack of licensing and repeated regulator warnings, nor the concentration of credible exposure reports tied to suspended accounts and frozen funds in 2024–2025.

Ownership, jurisdiction, and enforcement gaps

Coverage links Quotex to offshore entities (e.g., Maxbit LLC/SVG or Seychelles registration), emphasizing that SVGs FSA does not license or supervise forex/derivatives brokers, leaving clients without strong legal protections or compensation schemes. Overseas entity switching and multiple domains reported by reviewers make recourse even more difficult for affected users, a common pattern among offshore binary options brands.

Who should consider Quotex?

- Experienced traders prepared to treat any deposit as fully at risk and able to verify withdrawals at very small test amounts may choose to experiment—but only after acknowledging the full absence of regulated safeguards.

- Newer traders seeking education, transparent costs, and dispute resolution should prioritize brokers licensed by tier‑1 regulators (e.g., FCA, ASIC, NFA/CFTC), which Quotex lacks according to 2025 watchdog reporting.

Practical risk‑management checklist

- Verify regulation directly with the named regulators register before depositing; if not found, treat as unregulated.

- Start with tiny test withdrawals and avoid scaling until multiple successful, timely payouts are confirmed under identical methods.

- Keep independent trade records and screenshots to challenge discrepancies; numerous users cite chart or execution disputes.

- Avoid large balances or bonus schemes that can introduce withdrawal conditions or give brokers pretexts to restrict funds.

- If problems occur, document everything and file with relevant national authorities and consumer protection portals used to aggregate exposures.

Verdict: Is Quotex a high‑risk broker in 2025?

Yes—Quotex is high‑risk in 2025 due to its unregulated status, prior regulator warnings, and a sustained pattern of public complaints about suspended accounts and blocked withdrawals. While some users report satisfactory experiences with the platform and payouts, the lack of supervision and concentrated exposure reports make Quotex unsuitable for anyone who requires robust fund protection and reliable recourse.

Conclusion

Quotexs appeal—simple onboarding, accessible platform, and broad binary options coverage—comes with material counterparty risk that is magnified by offshore registration and the absence of recognized regulatory oversight. Documented warnings from EU authorities and escalating 2024–2025 complaints over withdrawals and account suspensions tip the balance against treating Quotex as a safe venue for capital, especially for newer traders seeking durable protections. For those still considering Quotex, approach with extreme caution, test withdrawals early and often, and never deposit funds that cannot be afforded to lose entirely.

Dont be swayed by flashy marketing. Simply scan the QR code below to download the WikiFX App and quickly verify brokers right from your phone.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

MarketsVox Exposed: The Tactics Draining Traders’ Hard-Earned Capital

Seeing MarketsVox as a forex broker, which can help you earn monumental profit on your investments? You have set your sights on the wrong option, unfortunately. The forex broker has been disallowing withdrawals, charging a much higher spread, and duping many traders under the pretext of high returns. Read on!

Top Forex Demo Accounts for Beginners

In this guide, we will explore the top forex demo accounts for beginners. We aim to help you find the best platform for your trading practice. Let's dive into the world of forex demo accounts and discover the best options available.

Investing in OnFin? Absurd Withdrawal Conditions & Trade Manipulation May Spoil Your Trading Mood

Planning to invest in OnFin, the forex broker, which has been a nightmare for many forex traders? While withdrawal denials have remained perennial for them, trading manipulations, including the illegitimate disappearance of deposits, have put OnFin under the scanner. Traders have been vehemently expressing their frustration about the forex broker on various broker review platforms. In this article, we will share some complaints that made us expose this broker here.

MyFundedFX Review 2025

MyFundedFX Review 2025 — unregulated prop-style broker with simulated trading, mixed trust signals, rule changes, and payout claims. Is it high risk?

WikiFX Broker

Latest News

Datuk Seri Linked to RM8.4 Million Gold Investment Scam Under Police Probe

The Psychology Behind the Ascending Triangle Pattern in Forex

Charles Schwab Forex Review 2025: What Traders Should Know

The Global Inflation Outlook

What WikiFX Found When It Looked Into XS

ASIC Regulated Forex Brokers: A Comprehensive 2025 Guide

PrimeXBT Expands FSCA Licence and Enhances Crypto Services in 2025

How 3 Simple Steps Cost a Businessman INR 4 Crore in a Forex Scam

How Commodity Prices Affect Forex Correlation Charts

TopFX Launches Synthetic Indices Trading on cTrader Platform

Currency Calculator